What is IFF?

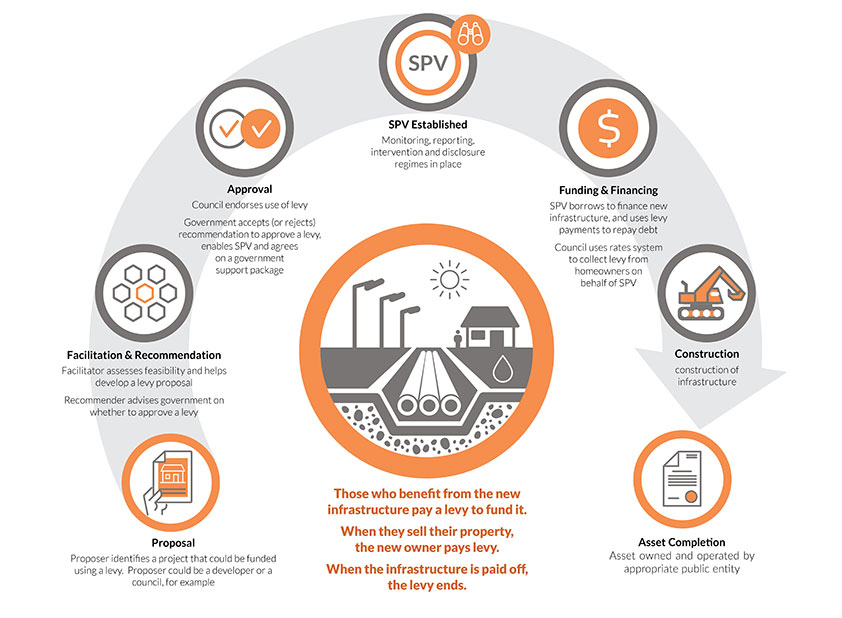

CIP continues to support infrastructure to enable housing and urban development through the implementation of alternative financing models. In August 2020 the Government enacted a new legislative tool under the Infrastructure Funding and Financing Act 2020 (IFF) and appointed CIP to the role of facilitator.

The tool makes the cost of new infrastructure more transparent while spreading the cost so it falls primarily on the property owners who benefit, including across generations.

Water and transport infrastructure (including cycleways and public transport projects) could be funded using the tool, as well as certain community amenities and environmental resilience infrastructure, such as flood protection.

The tool complements rather than replaces existing council planning and decision-making processes. Although not a silver bullet it is an important addition to a council’s funding and financing toolkit, helping them start viable housing and urban development projects sooner, unencumbered by financing constraints.

Key to the tool’s success is the ability to ring-fence infrastructure projects from the relevant council’s balance sheet so that there is no recourse to that council if the project fails.

A Special Purpose Vehicle (SPV), a stand-alone entity, will be created for each project (or a bundle of projects). It will be enabled by legislation to raise finance for the infrastructure project, collect a multi-year levy to repay the finance.

The levy would be paid by those who are expected to benefit from the infrastructure project for a period of up to 50 years. A Government Support Package would be agreed by the Minister of Finance, to cover certain tail end risks that can’t be managed by either the SPV or the council.

Who Pays What?

Affordability is a key issue that both local and central government have to consider when deciding whether to apply the tool.

The levy amount and term, along with who pays for the infrastructure (the project beneficiaries) will be agreed by Government based on the specifics of each project. The total amount to be collected will be capped.

When the property owners sells, the requirement to pay the levy will shift to the new owners. That requirement ends altogether once the infrastructure is paid for.

Allocation of the levy between beneficiaries could be determined by a range of factors, including land area, value and use, along with the level of benefits expected. While the amount a property owners pays could change over time, in broad terms they will know in advance how much they will need to pay based on what the project is expected to deliver.

Implementation of the Model

CIP’s role is to work with central government, local government, developers and land owners to assess the feasibility of an IFF transaction and advance the transaction through the process (including raising of finance).

CIP has worked with councils throughout the country to understand the constraints facing largescale housing and urban-development projects. CIP has developed a pipeline of projects that will benefit from financing through a model such as IFF over the next decade. These projects are large and complex and consequently have long lead times. CIP continues to support councils to progress the pipeline.

If you are considering the use of IFF for your project, Please see Applying the Model page.